3 Essential Financial Documents

Learn about your not-for-profit’s three essential financial documents and how they can support good governance, accountability, and transparency.

Authored by: iClick2Learn Team

Translate Text

Table of Contents

3 Essential Financial Documents

Many not-for-profit organisations rely on public and government support to achieve their objectives. As such, there are laws to regulate governance and financial reporting within NFPs.

Financial reporting is an integral part of your governance, and three financial reports should be presented and reviewed periodically. Because financial transparency and accountability are critical in the NFP sector, monitoring your financial statements can help you maintain a strong reputation and serve your mission effectively.

The 3 Financial Documents Available for Committee Review

Profit and Loss Statement

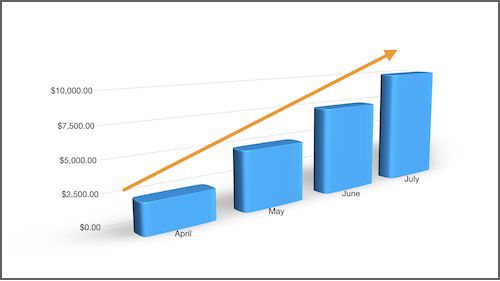

Not-for-profit organisations generate income through various sources, including grants, donations, fundraising, and membership. Your profit and loss statement (or income statement) tracks expenditures and revenue over time. Income might include member fees and fundraising appeals, while expenses include catering, inventory purchases, and repairs.

Your profit and loss statement should include information on the nature or function of your expenses. For example, the nature of expense method might note “depreciation” or “employee expenses,” while the function of expense method might note “administrative expenses” or “cost of sales.”

Your organisation’s profit and loss statement help:

- Address operational efficiency

- Highlight critical details about your expenses

- Evaluate your organisation’s performance

- Forecast your organisation’s future performance

Balance Sheet

Your balance sheet (or statement of financial position) includes information on your organisation’s assets (or what is owned) and liabilities (or what is owed.) It also covers the funds those liabilities and assets represent.

An organisation’s assets might include property, equipment, and investments, while liabilities might consist of trade creditors or bank loans.

Your balance sheet is essential for:

- Understanding important ratios

- Determining risk and return

- Showing how well your organisation is performing financially

- Reflecting your financial position at any given moment

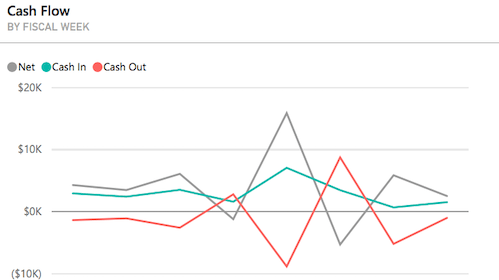

Cash Flow Projection

The cash inflows and outflows of your not-for-profit are outlined in your cash flow projection document. This statement contains information on financing activities, operating activities, and investing activities. It is imperative because it details precisely how all your funds are being used.

Operating activities might include payments to suppliers and employees, fundraising receipts, grant receipts, and member receipts. Bank loan repayment is an example of financing activity, while investments purchase is an example of investing activity.

Your cash flow projection:

- Displays all cash from all sources

- Shows how all organisational funds are used

- Can predict cash shortages and surpluses

- Provides a clear picture of your organisation’s future

You can see samples of all three documents here.

3 Essential Financial Documents: Conclusion

Not-for-profit board members carry a lot of responsibility. Everyone on the committee helps guide the organisation, shape its goals, and advance its objectives.

It can be helpful to consider these questions when reviewing financial statements:

- How well are we meeting our objectives?

- What is our economic strength?

- Are we collecting what is owed to us promptly?

- Have we fulfilled our commitments in exchange for funds received?

- Do we have a viable and sustainable future?

- Is our cash balance increasing or decreasing?

Reviewing financial reports can help your entire board gain a more comprehensive understanding of your organisation. Regularly assessing your organisation’s financial performance and position allows you to continue your essential service to the broader community.

Related posts

Developing a Fundraising Plan

Create a Sponsorship Plan

Develop Your Event Plan

Approving Your Budget

Top 10 tips for your grant budget

3 Ways to Find Grants Funds

Collaboration to Increase Opportunities

Staying On Top of Your Financials

Deductible Gift Recipients Status [Course]

Fundraising Risks for Registered Charities

Fundraising Risks for Community and Non Profit Organisations

What is Auspicing?

Fundraising and the Law

Understanding Common Financial Reports

Finance Basics

Understanding how to Read and Analyse your Financial Statements

Financial Controls That Protect you and Your Organisation

What are Audits and Which one do I Need?

Why you Need Financial Reports to Help Make Decisions

Forecasting your Financial Future is the key to Financial Success

Monitoring your Financial Position

Financial Controls

What is DGR status?

Understanding your Balance Sheet

Paying Committee Members

- Tags | Board, Boards, Committee, Committees, Finance, Financials