Financial Controls That Protect you and Your Organisation

Authored by:

iClick2Learn Team

Translate Text

‘Click the video titles below to view them’

Transcripts are available under the videos

Having financial systems and controls in place is a measure you take to reduce the chance of error, theft, embezzlement, and fraud. By following your process of checks and balances, your committee can confidently assure your stakeholders that your service is compliant with the law and operating efficiently and effectively. There are two different types of controls and a variety of systems within these controls. Internal controls are systems involving things like your policy and procedures on how authority is delegated at your service, use of checks and credit cards and commercial transactions, and scheduling activities related to legal compliance, and things like reporting to funders and the tax office.

This also includes making sure the trader provides accurate monthly financial reports to the committee to review your internal systems and communication processes across all levels of your service and its stakeholders. It’s also important to understand how you manage these controls within your committee, staff, and volunteers, and what the processes are to manage errors and issues. External controls will include one of the three following levels of reporting, starting with the lowest cost and lowest level of independent verification. A compilation is produced internally or by your accountant. It consists of a financial statement in a format that complies with generally-accepted accounting principles. It only uses information provided at that time and does not assure that the information is correct. A review is a little more thorough than a compilation. It may look at some areas and highlight those that could have had an effect on the interim financial report.

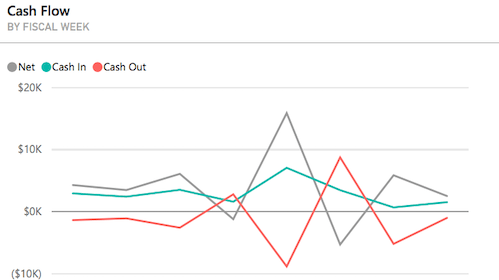

There is a limited amount of assurance conducted to verify the data. An audit is a professional and independent opinion as to whether your service’s financial statements are a fair and true record of your financial position, cash flow, and operating results. The auditors may question some transactions and examine relevant documentation. They may also conduct physical inspections and observations. As well as evaluate the internal controls at your service, consultation with internal and external stakeholders may also be required. Audits can vary in the amount of assurance and verification of the financial data. Standard audits generally only check a small, random sample of transactions to verify they’re lawful, within delegations, and appropriate.

Those audits that check every single transaction are called forensic audits. They’re generally called on when there are concerns of fraud or embezzlement. You should note your committee can’t solely rely on the auditor’s work as a substitute for the performance of their own duties. Auditors are not required to find all errors. However, they do have a legal responsibility for their opinion. They can be held liable for negligence if the audit is not completed according to professional standards, and for damage to the service as a result of any negligence.

Internal controls are systems involving things like your policy and procedures on how authority is delegated at your service, Use of checks and credit cards and commercial transactions and scheduling activities related to legal compliance and things like reporting to funders and the tax office.

This also includes making sure the treasurer provides accurate monthly financial reports to the committee to review your internal systems and communication processes across all levels of your service and its stakeholders. It’s also important to understand how you manage these controls within your committee, staff, and volunteers and what the processes are to manage errors and issues.

External controls will include one of the three following levels of reporting, starting with the lowest cost and lowest level of independent verification. A compilation is produced internally or by your accountant. It consists of a financial statement in a format that complies with generally accepted accounting principles. It only uses information provided at that time and does not assure that the information is correct.

A review is a little more thorough than a compilation. It may look at some areas and highlight those that could have had an effect on the interim financial report. There is a limited amount of assurance conducted to verify the data. An audit is a professional and independent opinion as to whether your service’s financial statements are a fair and true record of your financial position, cash flow, and operating results. The auditors may question some transactions and examine relevant documentation.

They may also conduct physical inspections and observations as well as evaluate the internal controls at your service, consultation with internal and external stakeholders may also be required. Audits can vary in the amount of assurance and verification of the financial data. Standard audits generally only check a small, random sample of transactions to verify they are lawful, within delegations and appropriate.

Those audits that check every single transaction are called forensic audits. They’re generally called on when there are concerns of fraud or embezzlement. You should note, your committee can’t solely rely on the auditor’s work as a substitute for the performance of their own duties. Auditors are not required to find all errors. However, they do have a legal responsibility for their opinion. They can be held liable for negligence if the audit is not completed according to professional standards and for damage to the service as a result of any negligence.

Related posts

Developing a Fundraising Plan

Create a Sponsorship Plan

Develop Your Event Plan

Approving Your Budget

Top 10 tips for your grant budget

3 Essential Financial Documents

Staying On Top of Your Financials

What is Auspicing?

Understanding Common Financial Reports

Finance Basics

Understanding how to Read and Analyse your Financial Statements

What are Audits and Which one do I Need?

Why you Need Financial Reports to Help Make Decisions

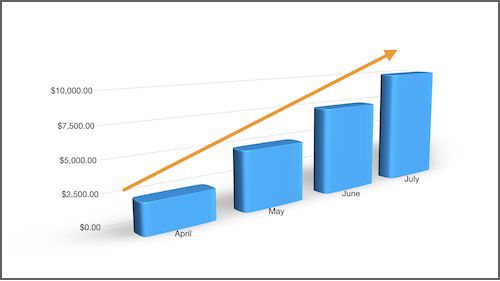

Forecasting your Financial Future is the key to Financial Success

Monitoring your Financial Position

Financial Controls

Understanding your Balance Sheet

Paying Committee Members

Key Financial Terms

How to Assess your Financial Health

- Tags | Accounts, Compliance, Financials