Key Financial Terms

Authored by:

iClick2Learn Team

Translate Text

Video Transcript

Assets are everything your service owns, such as cash, accounts receivable, and vehicles. Liabilities are everything your service owes, including loans, bank overdraft, and creditor invoices. Current means something that will be dealt with in the next 12 months. For example, current assets will be expected to be converted into cash within 12 months, and current liabilities are expected to be paid in the next 12 months.

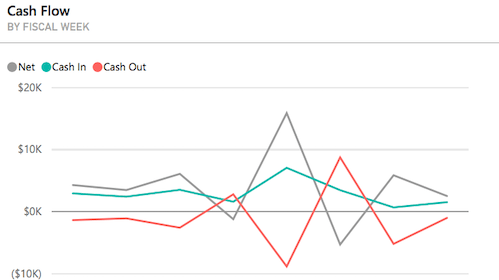

Non-current refers to things that will be dealt with over a period longer than 12 months. For example, non-current assets will be retained longer than 12 months, and non-current liabilities will be paid after 12 months. If you use an accrual accounting system, this means you record expenses and sales when they take place regardless of when cash actually changes hands. Cash accounting, on the other hand, tracks the actual money coming in and out of your service in real-time and doesn’t track what is expected to come in or out in the future. In cash accounting, if you get an invoice for something that you don’t record the cost in your books until you’ve actually paid the invoice. Liquidity means having enough cash to meet your current liabilities. Solvency relates to your ability to meet all of your total liability commitments.

A ledger name is a term given to the names of the categories we use in the Standard Chart Of Accounts. For example, the word accounts receivable listed on a report is a ledger name. These are some of the financial terms we’ll be referring to in this section.

Related posts

Developing a Fundraising Plan

Create a Sponsorship Plan

Develop Your Event Plan

Approving Your Budget

Top 10 tips for your grant budget

3 Essential Financial Documents

Staying On Top of Your Financials

What is Auspicing?

Understanding Common Financial Reports

Finance Basics

Understanding how to Read and Analyse your Financial Statements

Financial Controls That Protect you and Your Organisation

What are Audits and Which one do I Need?

Why you Need Financial Reports to Help Make Decisions

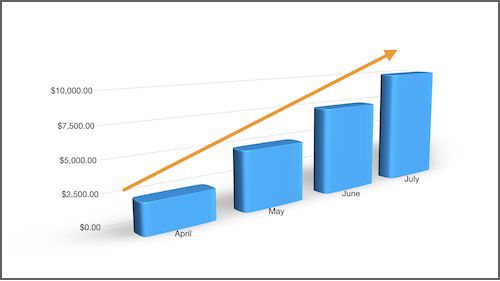

Forecasting your Financial Future is the key to Financial Success

Monitoring your Financial Position

Financial Controls

Understanding your Balance Sheet

Paying Committee Members

How to Assess your Financial Health

Align Strategy and Finances

- Tags | Financials